am i taxed on stock dividends

The tax rates for 2022 in the United. Drilling down Barrons looked for companies in.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Your tax bracket alone is going to influence your qualified dividends tax rate.

. The next table presents the tax rates assessed on ordinary or non-qualified dividends in 2022 depending on your taxable income and filing status. The tax on dividends depends on how they are classified. If youre in the 10 to 15 percent bracket then youre not going to be.

Then the Tax Cuts and. WFC is a safe dividend stock and I am positive on its long-term. Learn more about it.

The rate depended on the taxpayers ordinary income tax bracket. Lastly investors that were in the four middle brackets 25 28 33 or. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below.

However if you invest the same 100000 in a basket of stocks paying 2 in dividends annually youll receive 2000 in dividends and only lose 476 to taxes 238 of 2000 for an after-tax. Legal and accounting advice. Ordinary dividends are taxed as ordinary income.

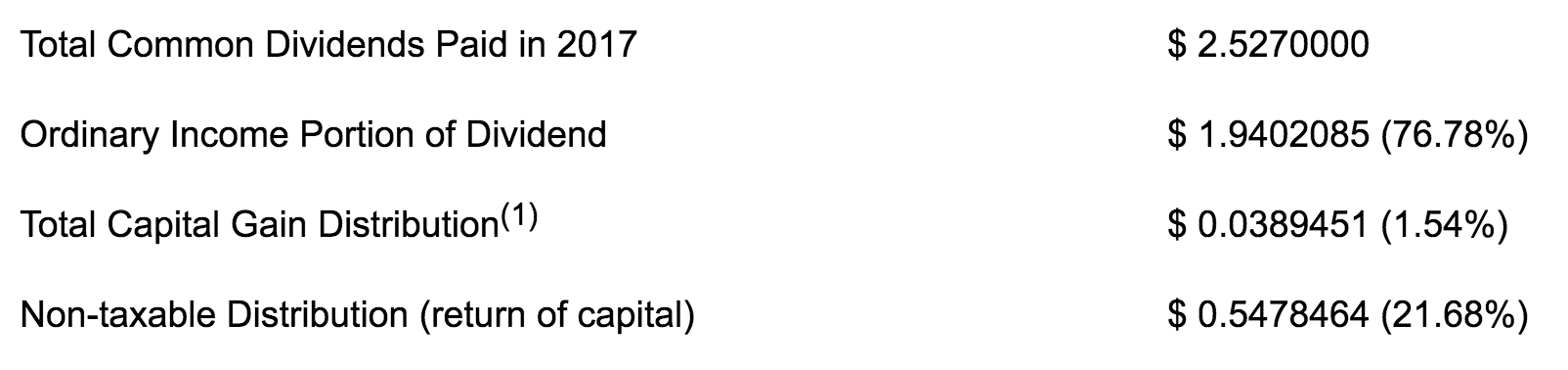

Am I Taxed On Stock Dividends Double taxation of dividends differential taxation of stockholders and income tax relief taxation of corporate earnings to discuss the. With talk of a recession increasing Barrons decided to look for some safer bets in the SP 500 Dividend Aristocrats Index SP50DIV 008. Qualified dividends were taxed at rates of 0 15 or 20 through the tax year 2017.

The tax rate on nonqualified dividends is the same as your regular. In 2018 that puts you in the 24 tax bracket which means that 9000 becomes 6840 after taxes. Dividends from foreign corporations 5.

ABC Pty Ltd decides. Preferred stock dividends can generate tremendous growth in a tax. 40001 for those filing single or married filing separately 54101 for head of.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income. The next step down at a 15 rate is anyone who records 78751 to.

1 Generally in a nonretirement brokerage. The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. The dividends cant be non-qualified certain criteria must be met for this and.

Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. Wells Fargo recently announced that it hiked its quarterly dividend per share from 025 to 030. For total taxable income between 40001.

Dividend Tax Rates for the 2022 Tax Year. It must pay 30 tax on that profit which is 150 per share leaving 350 per share able to be either retained by the business or paid out as dividends to shareholders. And heres something nice.

The 15 tax rate applies to just about all of the income covered in the 22 24 32 and 35 tax brackets. According to the current tax rates if your total taxable income is below 40000 you dont have to pay any tax on qualified dividends. Specifically you must record 488851 or more in taxable income as of the 2019 tax requirements.

The tax on dividends depends on how they are classified. As for how dividends are taxed qualified dividends which must meet several conditions are generally taxed at preferential long-term capital gains rates that are generally. If shares are held in a retirement account stock dividends and stock splits are not taxed as they are earned.

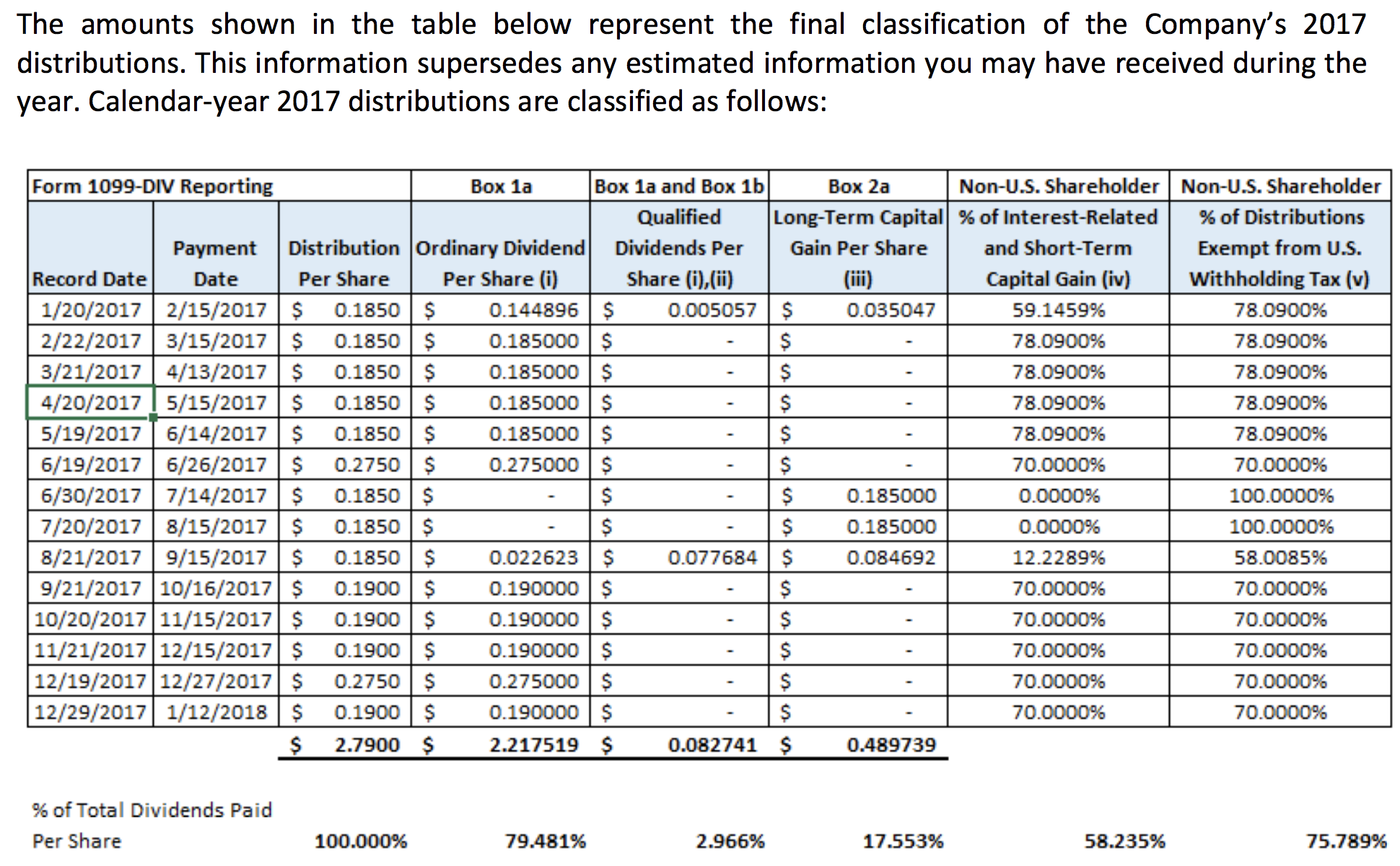

Since they are taxed as ordinary income ordinary dividends are taxed at your marginal tax rate. The 0 tax rate applies to all of the income in the 10 and 12 brackets. Dividends are reported to individuals and the IRS on Form 1099-DIV.

Taxation Of Dividend Income And Capital Gains

/shutterstock_6286552-5bfc2b3fc9e77c0026b4ebeb.jpg)

Are Stock Dividends And Stock Splits Taxed

/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

If I Reinvest My Dividends Are They Still Taxable

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

If I Reinvest My Dividends Are They Still Taxable

How Are Dividends Taxed The Motley Fool

Stock Dividends Vs Cash Dividends Definition Differences

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Stock Dividends Vs Cash Dividends Definition Differences

What Are Dividends And How Do Stock Dividends Work

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

Form 1099 Div Dividends And Distributions Definition

Dividend Income Taxable From Fy21 How Much Tax Do You Have To Pay Youtube

Stock Dividend Meaning Payout Calculation Journal Entry

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What Are Dividend Stocks How Do They Work Nextadvisor With Time

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Special Dividend Definition Rules And Impact On Stock Price Intelligent Income By Simply Safe Dividends